Kenya is currently experiencing a high rate of ‘inflation’ and the cost of living, goods and services, is rising quickly, believe it or not, much faster than our wages. The sudden sharp increase in the cost of basic needs like wheat flour, maize meal flour and cooking oil, just to mention a few, is creating daily unending conversation among Kenyans.

From many interactions on social media, you can tell that most Kenyans are increasingly worried that, at this rate of economic instability, their living standards will be highly impacted. We have not mentioned the distress created in the transport industry, a real headache, because of high fuel prices.

What is Kenya’s inflation rate?

According to trading economics April 2022 report, the annual inflation rate in Kenya has accelerated to a seven-month high of 6.47% in April of 2022, from 5.56% in the previous month. The main upward pressure being food & non-alcoholic beverages at (12.15%), wheat and basic goods, transportation at (6.88%), and thanks to another increase in fuel prices, housing & utilities at (5.47%).

These statistics create worry for the common mwananchi, but even so, these worries are justified. Inflation can have a negative impact on the quality of life, especially for those with lower incomes. However, we can make some adjustments in our choices like, how we budget, where we shop and where we choose to stash our savings, which can help you survive the effects of high inflation.

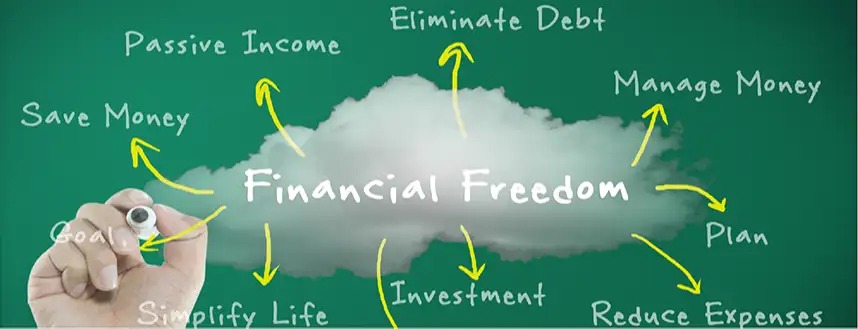

How to survive this inflation

High inflation Is clearly a cause of financial stress to many. It’s the high time for people to diversify by Increasing their monthly income to align It with current prices in order to survive the inflation, but that’s easier said than done for many reasons.

Here are some other ways to manage soaring costs if making extra money isn’t an option right now:

1. Focus on needs and reassess the wants

Start by determining your wants, (things you spend on but you can do without) from your needs, to ensure that only essential needs, (things you cannot do without and must spend on) are covered, like rent, groceries, transportation and utilities.

For many, this reassessment may result in pressing pause on wants like dining out, subscription services or gym memberships, etc.

2. Be wary of taking on new debts

Although some banks in Kenya reduced loan interest rates during the pandemic, these rates, increased post pandemic in Kenya, for this reason take on new debts sparingly, even if they have crazy low interest rates. New debts add to new constant monthly expenditure on your monthly budget which reduces your financial freedom during this inflation period.

You can also opt to consolidate the unpredictable high interest credit card loans into personal loans with fixed payment periods

3. Be a sale shopper

Talking about essentials, now is the time to get more serious about becoming a bargain hunter. This doesn’t mean you go crazy on coupon hunting, but rather pay more attention to discounts, offers, promo sales and allow them to guide you when you set out for shopping.

You can also opt for alternative free payment options for your day to day transactions. This will highly cut on transaction costs for common payments, that when accumulated, hit hard on your expenditure.

Check out how I&M On The Go facilitates transactions like paybill, sending money, bank to bank transfers and so much more that are FREE or have extremely low rates compared to other options

4. Maximize on loyalties and reward programs

This is the time to be on the lookout for shopping mall loyalty programs like the Carrefour My Club points, Naivas Card points and many more and convert them to cash before you go on that shopping spree.

Don’t forget about your best credit cards or best debit card rewards and points accumulated over time and redeem them for cash backs, travel discounts and more deals.

Check out some I&M Bank deals here

5. Invest your savings to get higher returns

We all know that time in the market beats timing the market. You don’t need to wait for the right time in order to begin investing for you to grow your income. From our best knowledge, you can invest your savings through the I&M Capital Limited and earn income in the most sure and secure way. This not only gives you a safe way of earning but also comes with professional advisories through the Wealth Management Advisory Services (WMAS) on below.

- Money market fund

- Offshore trading

- Lending against government bonds

- Client portfolio advisory

This is the moment where you not only need to save but also need smart and secure investments options that are beneficial directly to your financial security.

6. Look for alternative sources of income

This is easier said than done, but not impossible. When the pandemic hit, most Kenyans realized that over dependence on one source of income is a risky path because of the many uncertainties. It prompted many to look for more flexible alternatives for income and Online jobs played a huge role.

What are we saying, since we have cut back on the wants, we've got more free time on our hands, why not add an extra online job to compliment your daily job and save the difference in your earnings. Online jobs can be found on Upwork, Fiver, employment and many more

You can also opt in for affiliate programs like Jumia KOL & Amazon affiliates or referral programs that add you that extra income to help survive this tough times.

By Omido Joshua