Outstanding purchasing power and top-of-the-line features and benefits. Take advantage of handpicked travel, lifestyle, and insurance benefits that are designed to help you enjoy the finest luxuries in life. Furthermore, access personalized assistance whenever you need it to cultivate the lifestyle that suits you and to help you create extraordinary experiences.

Select Country

Select Country

I&M OTG - Personal

A new way to bank away from the bank

This is Section 2 header

This is description of section 2

This is section 4

Section 4 description

I&M On The Go

Come experience our state of the art I&M On The Go (OTG) Personal Mobile App and Web channel. I&M On The Go has been developed with your needs in mind.You will now experience a simple and easy to use interface on both mobile and web.

I&M OTG is More than just Banking!

Get started with I&M On The Go in a few steps

Download the I&M On The Go App

Select the Self-Register option

Follow the prompts and start transacting!

Section 6

Test this

yes

Why offshore?

- You may have thought about the advantages of offshore banking but you’re not sure if it is right for you?

- Firstly, you should know that you’re not alone. There are hundreds of thousands of people like you across the continent who find real value in accessing offshore banking solutions.

- They, like you, are looking for a stable, secure and transparent jurisdiction, where they can seamlessly manage all their international financial needs in a tax-efficient way and benefit from the best of global investment solutions. And increasingly, they’re turning to the island of Mauritius to fulfil – and exceed – those needs.

Mission

Tthis is our missiong

Value

This is our value

Benefits

Banking, but better!

Account Balance

View account balance on your app. Unlock balance with a single tap.

Quick Link

Quick link for most used payment types.

Overview

All accounts overview on a single window

Payments

Mobile Money, Local and International Payments

Other Payments

Airtime | Utility | Pesalink | KRA Payments

Approval

Approval policy for Joint Account Holders

Service Requests

Stop Cheque | Lock/Unlock - Temporary Block. More feature coming soon

Authentication

Authentication through SMS/E-Mail or Google Authenticator and so much more!

Download / Access Now

I&M On The Go is a convenient and secure way to do banking.

Test

Apply in person

Request Call Back

One of our representatives will call you back as soon as possible.

We are available from 9:00 AM to 4:00 PM Weekly.

Apply for a loan

One of our representatives will call you back as soon as possible.

We are available from 9:00 AM to 4:00 PM Weekly.

Home Loan Calculator

EMI

This is EMI Section 11

Section 11 footer text

Section 13

Heading

Section 15

Section 15

Section 15

Section 15

Produucts section 7

Insurance

- One

- Two

- Three

- Four

- Firve

Bancassurance

- Moja

- Mbili

- Tatu

- Nne

- Tano

This is section 12

| Card Prise | 200 |

| Recharge | 200 |

| Replacement | 300 |

This is section 14 Partnerships

Logos for partnerrships

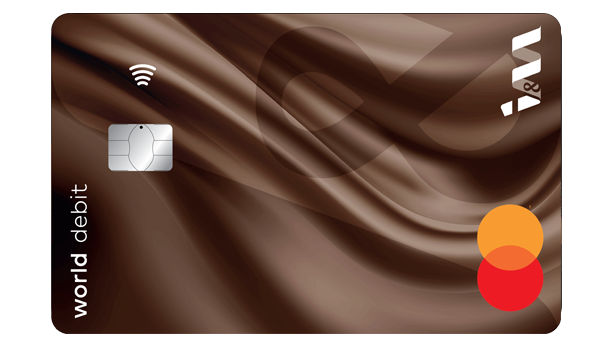

Cards Compare Section 19

Select a card

I&M Platinum Debit Mastercard

Card Issuance Fee

Kes 500

Annual Fee

Free

Renewal Fee

Kes 500

Replacement Fee

Kes 500

Local ATMs

30

Other Bank/International ATMs

50

I&M World Elite Debit Mastercard

Card Issuance Fee

Free

Annual Fee

Free

Renewal Fee

Free

Replacement Fee

Free

Local ATMs

Free

Other Bank/International ATMs

Free

I&M World Debit Mastercard

Card Issuance Fee

Free

Annual Fee

Free

Renewal Fee

Free

Replacement Fee

Free

Local ATMs

Free

Other Bank/International ATMs

Free

I&M Visa Debit Card

Card issuance: Free (1st year, except for ATM salary A/c), every subsequent year

Kes 350

Card Replacement

Kes 350

PIN Replacement

Kes 250

Withdrawal fees: - Per withdrawal for I&M Bank ATMs

Kes 33

Withdrawal fees: - Per withdrawal for local VISA ATMs

Kes 55

I&M Visa Platinum Debit Card

Card annual fees

$5

Card Replacement

Kes 350

PIN replacement (*charges applicable for hard copy PINs)

Kes 250

Withdrawal fees: Per withdrawal for I&M Bank ATM

Kes 33

Withdrawal fees: Per withdrawal for local VISA ATM

Kes 55

I&M USD Visa Debit Card

Card annual fees

$5

Card Replacement

$5

PIN Replacement fee

$ 2.75

I&M Bank ATM Transaction fee

$1

Visa ATM Transaction fee

USD 2 (other bank’s surcharge may apply)

Compare Accounts

Select an account

I&M Fikisha Goalz Savings Account

Free

To open and operate

Self-account opening

Through I&M Bank On The Go (OTG) App

Multiple Goal Saving Accounts

Save for multiple goals independently

Account charge

Nill

Start amount

As little as Kes 1,000 savings per month

Automatic Standing Instructions from your I&M Bank Transaction Account

Free

Interest

Earn interest at 8% p.a. on monthly average balances from kes 1000. Interest paid out monthly.

Tracking

Track the progress of your goal any time

Withdrawals

Two withdrawals allowed per month. Interest for a given month forfeited if more than 2 withdrawals are made in the month.

I&M Savers Account

Opening Balance

Kes 1,000

Minimum Balance

Nil but minimum interest earning balance is Kes 5,000

Transfers within I&M

Free

Interest

Up to 7.85% p.a.

Interest Payment Frequency

Monthly

Withdrawals

Limited to 2 withdrawals per month after which interest is forfeited for that month.

Account Opening

Through any I&M Branch or online channels. It is easy and free to open!

24/7 Banking

View balance and transfer funds anytime through Online Channels

Deposits

Unlimited deposits of any amount by Cash, MPESA, Cheques or Transfers from other accounts

Flexi Deposit Builder

For KES Flexi Deposit Builder: Minimum monthly Instalment

1,000/-

Term

1 Year

For USD Flexi Deposit Builder: Minimum monthly Instalment

100

Term

1 Year

Fixed Deposit

Minimum Deposit

50,000/-

Term

1 month to 1yr