Here is the thing about change; it is inevitable and comes with a package of impacts. We were going about our businesses as usual until boom! A new reality hit us; COVID-19. This is how it must have felt like to our ancestors 100 years ago during the last worldwide Spanish flu pandemic of 1920 that decimated anywhere between 17 and 50 million people………but without the internet age in which we are living in today and the mass personal travel available meaning that the spread of this novel virus was transmitted at the speed of light!

Positively though advances in medical sciences in the last 100 years also means that we have better protocols of managing the medical cases arising from COVID-19 (as well as other viral infections) and in all possibility restricting the devastation and number of deaths worldwide.

We are now living in uncertain times brought on by COVID-19 and we find ourselves faced with the reality of a new normal. The sad reality is that we didn’t see it coming….after all who anticipates such things!!

Businesses, sole proprietors, corporates, individuals etc, are all seeking insights and solutions on how to adapt to this new normal. As an inevitable part of their role, business leaders have to find ways to navigate through the crisis in a bid to sustain business continuity…..a difficult job at the best of times and doubly so now.

The world is changing around us, but let’s not forget that so is the novel COVID-19. So, what do we do? How do we go from here? So many questions running through our minds and even more confusion fueled by all kinds of conspiracy theorists which isn’t helping matters much…………. including the price of oil!

The time to face the unpleasant truths and to look past the brick and mortar way of doing business has come. Let us forge a new path ahead, beyond the uncertainty we are in. Do we have all the answers? Well, one thing is for sure, we can certainly point you in the right direction because we are on your side!

Now, let me take you through the global context of current happenings as well as a few pointers to help you navigate through this difficult and evolving economic situation. I’ll try to keep it simple so that I don’t lose too many of you along the way……….. more so those working from home!

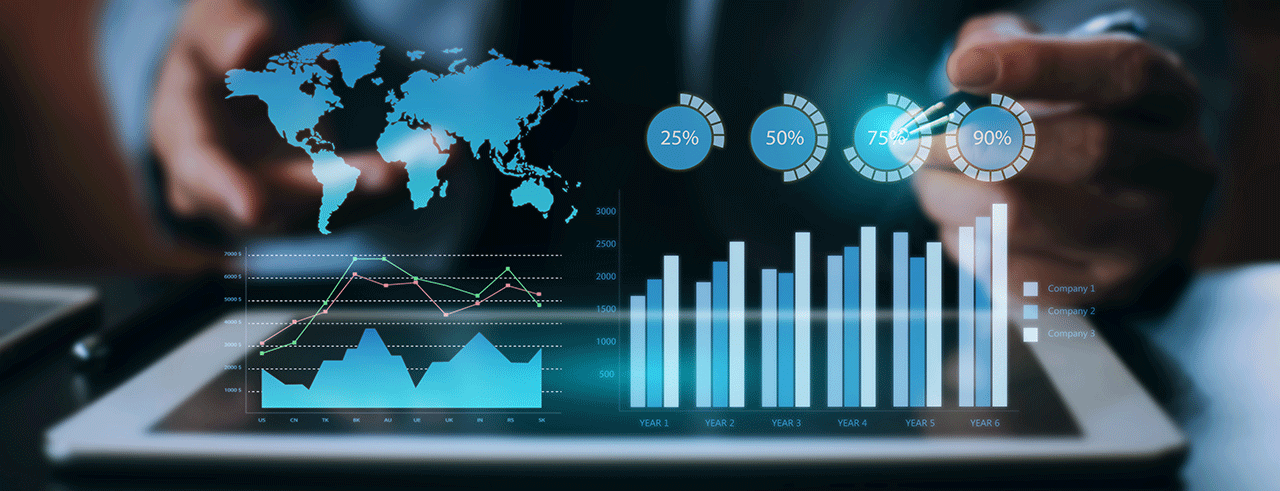

The Global Context

Right from the onset of the pandemic, various economies around the globe experienced an economic downturn. As a matter of fact, the consensus position from business commentators predicts a recession and in the worst-case scenario, an economic depression. There’s a struggle to sustain businesses owing to imposed curfews, restrictions and lockdowns, such that businesses have been forced to respond in ways that have led to inevitable effects to the labour market. One of the major implications that cuts across the business landscape is the significant number of layoffs in an effort to cut on costs of operation. In case you were affected by this unprecedented effect, do not lose hope for we will eventually find ways to navigate through the pandemic.

There has also been major disruption in supply chains, resulting in a knock-on effect on various industries owing to unprecedented outcome with respect to the pandemic. For instance, insurance and oil markets have experienced major setbacks. Insurers are not receiving claims as people reluctant to visit hospitals in the fear of being infected. In some cases, global policies are actually implementing this limiting measure to avoid overwhelming the health systems, more than they already are.

While we have seen reduction in oil prices, this price dipping effect was felt way before the epitome of the coronavirus pandemic. Price wars within OPEC, arose from issues revolving around overproduction. In the new dawn, immediate effect was however suddenly felt owing to the unexpected outcomes travel restrictions that suddenly led to reduction in particularly personal transport, hence low demand for oil.

On the bright side, there have been attempts by governments and central banks around the world to mitigate the effects of the coronavirus pandemic.

Like with every crisis, particularly arising from health issues, we expect changes to take root in terms of ways of working around the pandemic. Immediate focus by different governments is to quickly get economies back on track. This is expected to take all sorts of forms; the principal ones being fiscal and monetary policy measures, to allow business to recover from trade shocks.

Some of the measures taken to contain the economic damage on a global landscape are but not limited to:Tax reduction to encourage circulation of moneySovereign guarantees to support affected businesses such as additional funding to health sectors and assistance in the form of unemployment benefits.Tax deferrals to allow companies that are in the business of supplying essential services to defer payment of profit tax for a specified period.Introduction of policy measures which have been occasioned by Central bank trying to lessen the impact of the crisis on economies. E.g. reduction of interest rates.Stimulus packages aimed at cushioning individuals and businesses against the impact of COVID-19

Still on a positive note, we have witnessed the green effect of cleaner air as land borne/airborne/seaborne pollution emissions have reduced. On the social front, families are spending ample time together. Other positive effects would be the realm of changes on business models. Businesses have been forced to rethink their business models on ways to work better to enhance business continuity. An evident outcome of the reassessing process is allowing work on a virtual basis while maintaining the desired level of productivity, which is by far a great way to cut on costs.

Despite the uncertainty, some businesses are actually thriving despite the given circumstances, having been lucky enough to experience a rise in demand for essential goods and services. So, in the next blog article, we shall have a look at which some of these businesses are and most especially, how these businesses are grabbing the available opportunities in order to boost business continuity.

Stay tuned for the next issue!

Until then, stay safe!